Washington state long term care trust act opt out

Gray wolf conservation classification open for public comment

Gray wolf bills take center stage this legislative session

Fur is under legislative fire . again

New H-2A bills ignore reality of farm wages

Latest from Education

Proposed bill would cut funding to schools that do not adopt controversial state-imposed curriculum

HB 2331 would create yet another reason for families to leave the public education system

HB 2331 would defund schools that do not adopt controversial curriculum mandated by the state

WEA union blocks bill to provide equitable funding for charter school families

Latest from Environment

Gov. Inslee's latest wasteful EV subsidy is the equivalent of paying $1,125 for a latte

Earth Day 2024: Time to admit that government-run environmentalism is failing

As state’s CO2 tax faces voters, Inslee Administration using taxpayer funds to campaign for policy

Latest from Government Reform

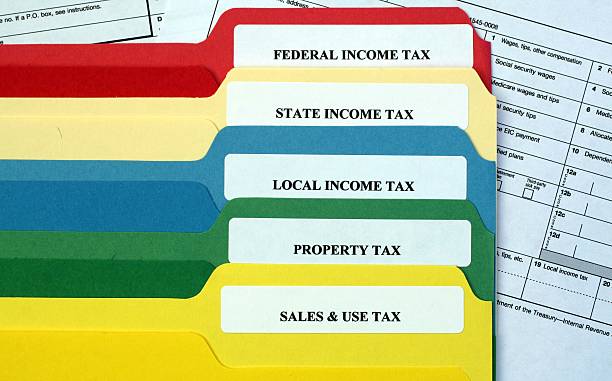

Legislature passes I-2111: Now lawmakers should seal the deal

Fact Check: Repealing the capital gains income tax will “devastate” basic education. Is that true?

Inslee is wanting to be remembered for COVID-19 response?

Patient access demands abandoning Washington state’s Certificate of Need program

Hospital-at-home programs offer an innovative solution to freeing up hospital beds

Latest from Small Business

House Bill 2474 would allow unelected bureaucrats to put homeless housing into your neighborhood

House Democrats pass rent control House Bill 2114 guaranteeing an increase in rent

Senate Bill 5570, removing the 1% cap on property taxes, has failed to pass this year

Minimum Wage hikes, predictably, increase the cost of fast food – is a $10 Big Mac on the horizon?

Latest from Transportation

Transit taxes and unaffordable housing

Sound Transit to seek state funding

Implications of Shifts in Commuting

Latest from Worker Rights

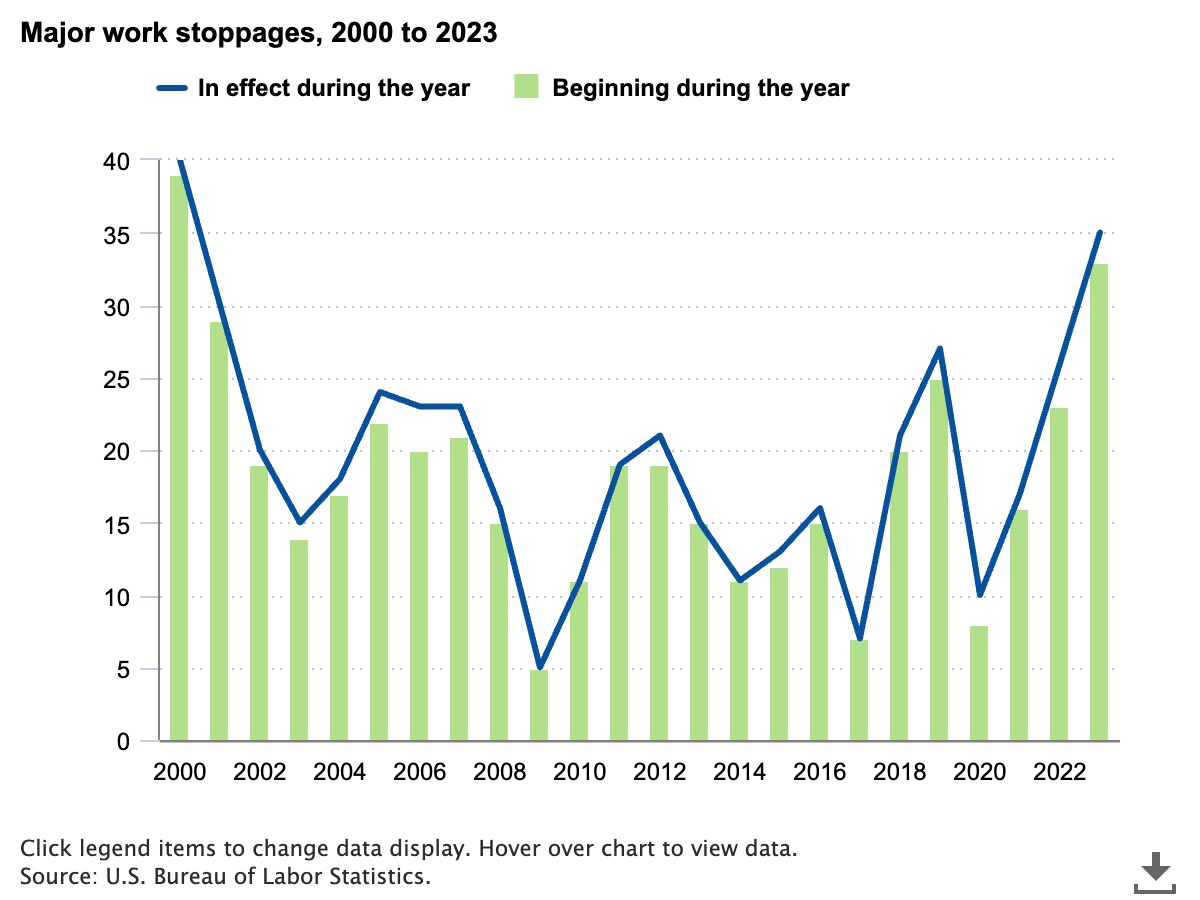

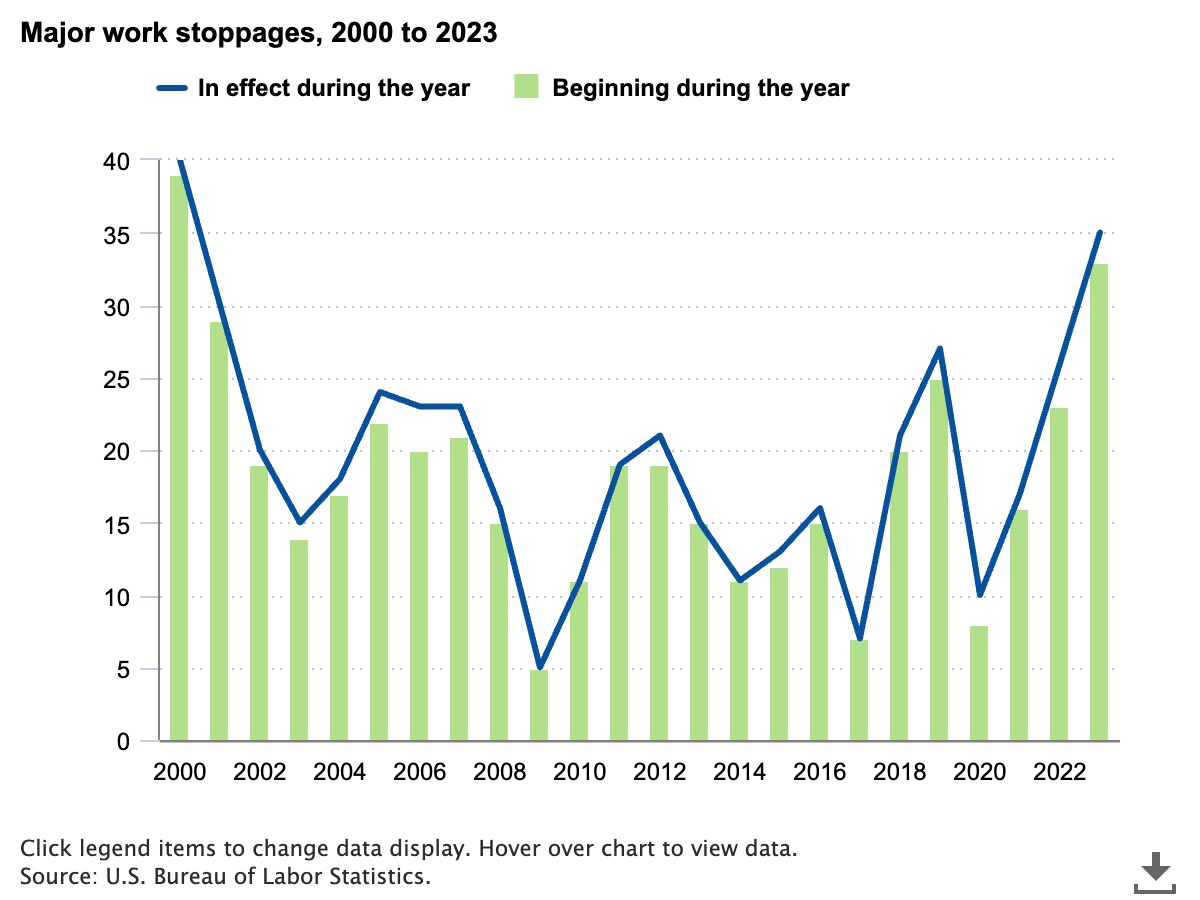

Labor promises legislation to pay striking workers will be back

Portability change means a WA Cares benefit? Don't count on it

Workforce issue rightly in focus in Olympia: SB 5815, to join a licensure compact for physician assistants, passed the Senate, moves to House

Paid leave isn’t primarily helping people in need, it’s going to middle- and upper-income wage earners

Latest from WPC en Espanol

La agencia de Washington dice que la descarbonización no es una prioridad de la “descarbonización comunitaria” financiada por el impuesto al CO2

Los beneficios de WA Cares no siguen el ritmo del costo de atención

El fallo sobre el salario de los trabajadores agrícolas es una mala noticia para todos

Cuando los procesos de permisos gubernamentales matan a las pequeñas empresas

Read

About

How to opt out: Follow this yellow brick road to apply for exemption from long-term-care payroll tax

- Blog

- ELIZABETH NEW (HOVDE)

- Oct 1, 2021

About the Author

Elizabeth New (Hovde)

Director, Center for Health Care and Center for Worker Rights

Email

PHONE

Related Articles

Government controlling the price of prescription drugs is not promising

Washington health insurance rates to jump nearly 11% in 2025

Some public employees who walkout over a contract they knew little about say strike not off table

The button works — for some people! Baby steps.

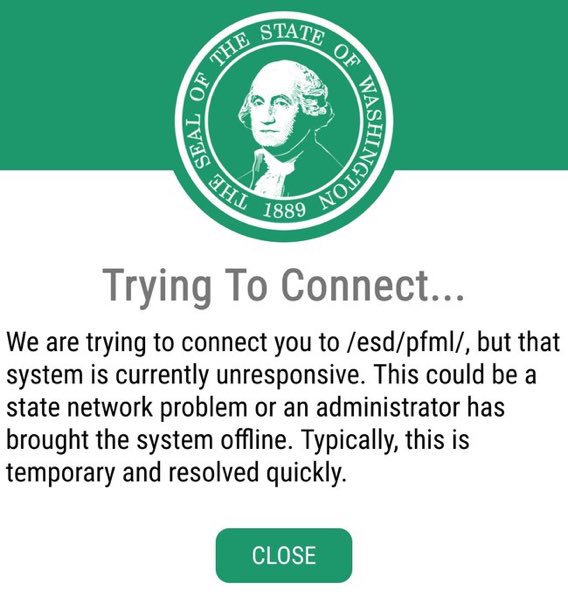

If you have private long-term-care insurance (LTCI) and want to opt out of a new long-term-care payroll tax starting in January, you can apply for an exemption with the state of Washington starting today. Maybe. For those who got in before the site crashed, minutes after it opened, I hear it was easy. I have not had success.

Read more about the regressive tax and misguided law that created it here.

This law concerning long-term care should be repealed by lawmakers. The new mandate burdens family budgets, makes false promises and takes away choices. For now, those who have private LTCI can apply to opt out of the state program and payroll tax by following the steps below.

- Go to an "apply for an exemption" button near the bottom of the “exemptions” page of the WA Cares Fund website. Click it and follow the directions on the next page you're linked to (be prepared to set up a Secure Access Washington (SAW) account and upload proof of identity).

- When you get to the actual exemption request, you'll need to click five boxes, including verification of age, that you have a private plan and that you are giving up access to the state's taxpayer-funded plan. Then submit.

- Wait for state officials to approve your application, which isn't the day you apply. The state might get back to you for more information.

- If your application is approved (watch for that in your SAW account information), there’s one more step: At some point, you’ll need to access a letter available through your SAW account and show it to your employer, so you won't be paying this payroll tax. You’ll need to show the letter to all future employers.

The window for application will stay open until December 2022. Remember, however: You need to have a private, qualifying plan before Nov. 1 of 2021 to even be considered for exemption. And unless you already have one in process, we've heard none are available until after that cut-off date.

I'm far more interested in policy than process, but people have been looking for process help with this task and finding little more than a public-relations campaign from the state. So here's some help. For specific questions, try contacting wacaresfund@dshs.wa.gov.

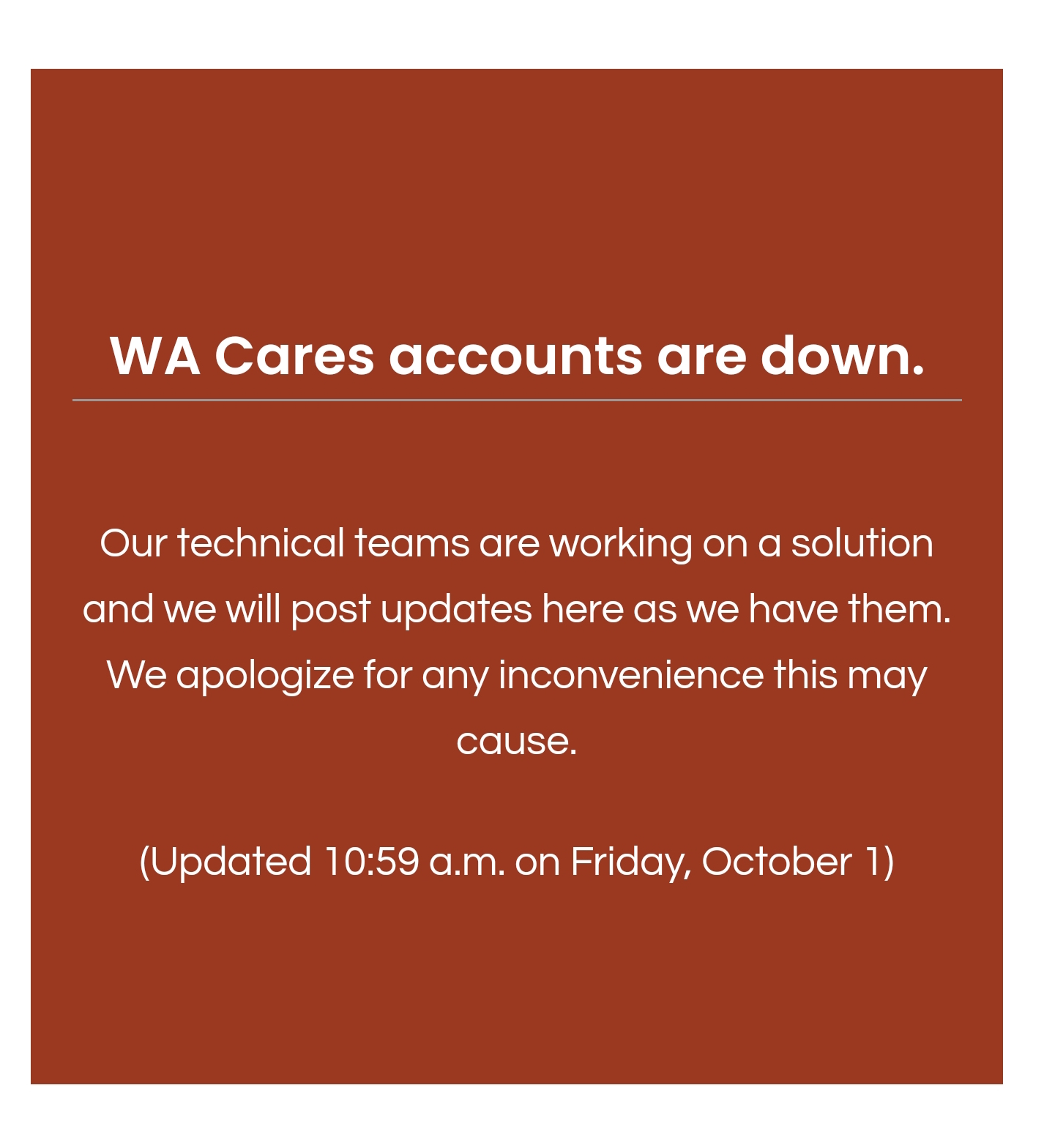

Update: This is the message some of us were getting in the 11 a.m. hour on Oct. 1.

Update: Most people I know, including me, were able to get through and apply on Saturday, Oct. 2 — after many tries and site shutdowns. I edited my bulleted instructions after seeing the process with my own eyes.